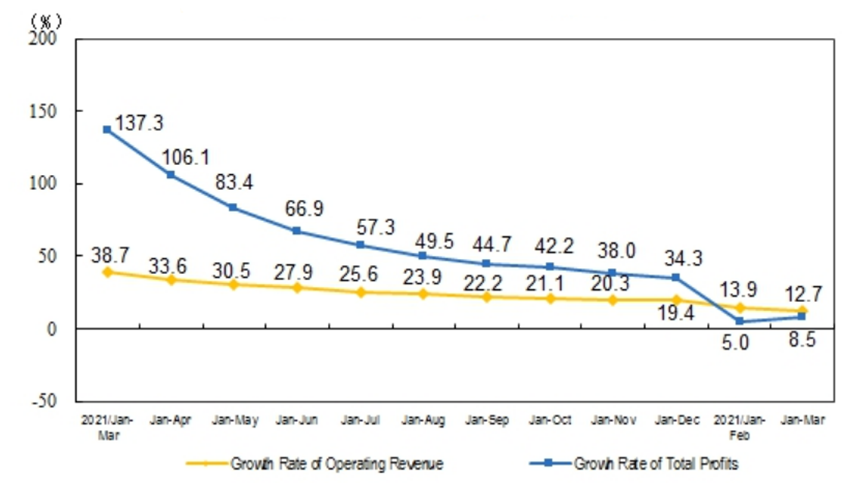

China's National Bureau of Statistics has recently released the latest data on industrial enterprises for the first quarter of this year. From January to March, industrial enterprises above the designated size achieved a total profit of RMB 1.95557 trillion, a year-on-year increase of 8.5%. From January to March, industrial enterprises above the designated size achieved operating revenue of RMB 31.27 trillion, a year-on-year increase of 12.7%. The operating cost was RMB 26.29 trillion, an increase of 13.5%. Meanwhile, the profit margin of operating revenue was 6.25%, a year-on-year decrease of 0.24 percentage points. At the end of March, the assets of industrial enterprises above the designated size totaled RMB 144.61 trillion, a year-on-year increase of 10.6%; liabilities totaled RMB 81.68 trillion, a rise of 10.5%. The total owner's equity was RMB 62.93 trillion, rising for 10.8%; and the asset-liability ratio was 56.5%, unchanged year-on-year.

Figure 1: Year-on-year growth rate of cumulative operating revenue and total profits in each month (%)

Source: National Bureau of Statistics

On the whole, except for the decline in profit margin, the growth rate of revenue and profit has picked up significantly compared with the previous two months, reflecting the overall recovery of China's domestic industrial sector under the macro-easing policy since the end of last year, matching the overall economic growth rate of 4.8% in the first quarter. Looking at the details, however, ANBOUND's researchers note that structural problems in the industrial sector are evident, and that they are in fact a reflection of structural contradiction in the country's overall economic situation. This structural contradiction is also reflected in the volatility of the capital market this year, affecting the stability of the domestic capital market. The worry is that the overall positive data mask these structural problems and give a false impression of economic stability, thus missing the opportunity to use macro policies to promote economic stability.

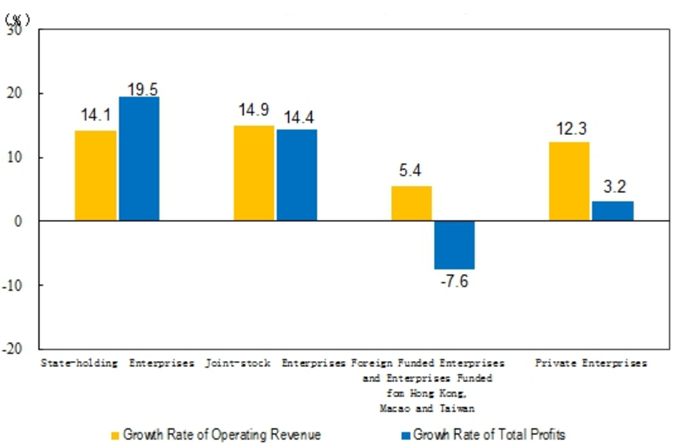

According to the data of the National Bureau of Statistics, although the overall profit growth has recovered, the profit growth of enterprises varies with the types of enterprises, and there is an obvious trend of differentiation. From January to March, among industrial enterprises above the designated size, state-owned holding enterprises achieved a total profit of RMB 706.85 billion, a year-on-year increase of 19.5%. Joint-stock enterprises realized a total profit of RMB 1.43963 trillion, an increase of 14.4%. The total profits of foreign-invested enterprises and enterprises invested by Hong Kong, Macao, and Taiwan reached RMB 470.75 billion, down 7.6%. The total profit of private enterprises was RMB 533.15 billion, an increase of 3.2%. In terms of revenue and profit growth, state-owned industrial enterprises have a great contrast compared with foreign-invested and private enterprises. In the view of ANBOUND, this contrast comes from two aspects. On the one hand, a large number of private and foreign-invested enterprises at the end of the industrial chain have to bear greater pressure from rising prices and costs, resulting in low or even negative profit growth. On the other hand, due to the stricter pandemic prevention and control policies, private and foreign-invested enterprises suffer a greater impact. In particular, foreign-invested enterprises tend to have longer supply chains and are more affected by the disruption of logistics and supply systems, thus experiencing a significant decline in operating revenue growth. From the perspective of this structural change, private and foreign-invested enterprises actually suffered more pressure in the first quarter. At the same time, the profits of state-owned enterprises and joint-stock enterprises, including state-owned assets, increased substantially, widening the gap between different types of enterprises. This has also made structural contradictions more prominent.

Figure 2: Year-on-year growth rate of operating revenue and total profits of different types of enterprises in January-March 2022 (%)

Source: National Bureau of Statistics.

It should be pointed out that in addition to the structural problems among different types of enterprises, the structural contradictions between different industries are also very prominent. From January to March, the mining industry realized a total profit of RMB 383.5 billion, a year-on-year increase of 1.48 times; the total profit of the manufacturing industry was RMB 1.47381 trillion, down 2.1%; the production and supply of electricity, heat, gas, and water realized a total profit of RMB 98.25 billion, a decrease of 30.3%. From January to March, among the 41 major industrial industries, the total profits of 24 industries increased year-on-year, 15 industries decreased, one industry reduced losses and one industry was flat. While many industries saw profit growth, manufacturing, which makes up the bulk of the industrial sector, saw profit decline, which is actually more noteworthy. As a major manufacturing country, the manufacturing industry plays an important role in China's economy and is also the source of its foreign trade competitiveness. The decline in manufacturing profits is also due to the pandemic control and the rising cost of resources, and more profits are appropriated by the upstream resource-based enterprises. The deepening of structural contradictions between industries will bring pressure to the operation of domestic manufacturing enterprises and further erode the competitive advantage of China's manufacturing industry.

What is more worrying is that the sharp decline in the profits of public enterprises brings hidden dangers to the whole economy and people's livelihood. From January to March, the production and supply of electricity, heat, gas, and water realized a total profit of RMB 98.25 billion, a decrease of 30.3%. The public service sector, on the one hand, bears the sharp rise in energy prices, on the other hand, also bears the responsibility for basic economic operations and people's livelihood. Under the background of reducing the burden of enterprises and residents, it is difficult to transfer the cost pressure to end-users. However, the decline in profits is bound to affect the development of enterprises and the stability of production capacity, thus bringing a potential negative impact on the economy and people's livelihood.

In particular, the coal and electricity industry, which experienced huge losses last year, still suffered substantial losses in the first quarter of this year due to the rise in thermal coal prices. China Electricity Council's (CEC) report pointed out that the overall price of thermal coal has continued to rise since the beginning of this year, resulting in a year-on-year increase of about RMB 130 billion in the purchase cost of thermal coal by coal and electricity enterprises nationwide in the first quarter. According to the CEC, more than half of the large power generation groups' coal power plants are still losing money as fuel costs have risen much faster than coal and electricity enterprises' selling prices. The continued losses of coal and electricity enterprises and the tight cash flow of some enterprises will increase the potential risks facing the power supply. As energy prices directly affect people's livelihood, energy prices are difficult to adjust accordingly to rising fuel costs, and the cogeneration enterprises are also suffering losses. CEC's report cited potential risks to coal and gas power supply during peak summer amid high volatility in thermal coal prices. It also suggested accelerating the formation of a market-based electricity pricing system to reasonably ease cost pressures in the upstream industry chain. This includes the formation of a market system and price mechanism that promote the construction of new power systems and relieve the pressure on electricity generation enterprises.

In fact, with the continuous disclosure of Chinese economic data and the performance of listed enterprises for the first quarter, the capital market has noticed these structural contradictions and begins to re-price and revalue the structural problems of industrial enterprises. The share prices of some state-owned energy enterprises have risen, while a large number of manufacturing enterprises and private enterprises continued to adjust their valuations downward, driving the overall market downward. These structural problems not only pose a threat to economic growth, but also directly affect the stability of capital markets.

The structural contradictions reflected in the operation of these industrial enterprises are also the primary problems to be solved in the current policy of building a unified domestic market. On the one hand, it is necessary to break down barriers in different fields and form an effective pricing mechanism to ease contradictions between different fields. On the other hand, it would be indispensable to provide special support to small and medium-sized enterprises, private enterprises, and foreign-invested enterprises to establish a fair competitive market environment. This will not only improve market efficiency, but also contribute to the stability and development of the capital market.

Final analysis conclusion:

Although the revenue and profits of China's industrial enterprises rebounded significantly in the first quarter, structural problems and contradictions have become more prominent. This requires apt policy consideration and response. Resolving these structural contradictions is also a focus of the country's long-term construction of a unified market.